In the last year, many have had to navigate job loss, business closures, and federal financial aid so as tax season approaches it’s more important than ever to get started early. Better Business Bureau serving Eastern North Carolina (BBB) offers the following information on the 2021 tax season.

“The pandemic brought with it unchartered territories in regards to employment and federal aid, leaving many Americans confused about their financial situation ahead of the tax filing deadline of April 15th,” said Mallory Wojciechowski, president and CEO of BBB. “To eliminate unnecessary frustration or financial loss, it’s important to remain vigilant against potential scams this tax season.”

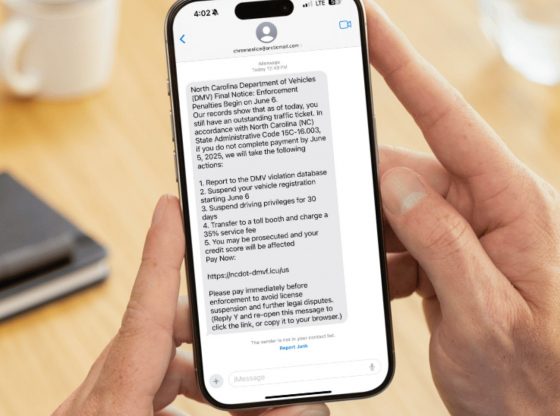

Each year con artists attempt to use Social Security Numbers of unsuspecting Americans to file phoney tax returns to try and steal refunds.

BBB offers the following tips to avoid scammers this tax season:

File early. The best way to avoid tax identity theft is to file your taxes as early as possible, before a scammer has the chance to use your information.

Watch out for red flags. If a written notice from the IRS arrives in the mail about a duplicate return, respond promptly. Or, if an IRS notice arrives stating you received wages from somewhere you never worked, or receive other notices that don’t actually apply to you, contact the IRS office immediately. Another big red flag is if you receive a notice that “additional taxes are owed, the refund will be offset or a collection action is being taken against you for a year you did not file a tax return” (IRS). Contact the IRS if you have any suspicions that your identity has been stolen.

Protect your Social Security number. Don’t give out your SSN unless there’s a good reason, and you’re sure who you’re giving it to.

Research your tax preparer. Make sure your tax preparer is trustworthy before handing over your personal information.

If you are a victim of ID theft, consider getting an Identity Protection PIN (IP PIN). This is a six-digit number, which, in addition to your Social Security number, confirms your identity. Once you apply, you must provide the IP Pin each year when you file your federal tax returns. Visit IRS.gov for more information.

BBB Tips for Hiring a Tax Preparer:

Filing taxes can be overwhelming, especially if you have a complex tax situation. This is why many Americans use a tax preparer to help them navigate the process, but there are a few things to consider before hiring someone to help:

Review the tax preparer’s credentials. Enrolled Agents, CPAs, and tax attorneys are all qualified to represent their clients to the IRS on all matters. Other preparers can help you with forms and basic matters, but cannot represent you in case of an audit.

Be wary of spectacular promises. If a tax preparer promises you larger refunds than the competition, this is a red flag. Many such tax preparers base their fees on the amount of your return and may be likely to use shady tax preparation tactics. In addition, it’s wise to avoid tax preparers who offer “refund anticipation loans” as you’ll probably lose a large percentage of your return to commission fees.

Get referrals from friends and family. One of the best ways to find a trustworthy tax preparer is to ask your loved ones for recommendations. Once you have a few options, check the org, paying careful attention to other consumers’ reviews or complaint details.

Think about availability. If the IRS finds errors in your tax forms or decides to perform an audit, will your tax preparer be available to help you with the details? Find out whether you can contact the tax preparer all year long or only during tax season.

Ask about fees ahead of time. Before you agree to any services, read contracts carefully and understand how much the tax preparer charges for their services. Ask about extra fees for e-filing state, federal, and local returns, as well as fees for any unexpected complications.

If things don’t add up, find someone else. If a tax preparer can’t verify their credentials, has a record of bad reviews from previous clients, or their business practices don’t seem convincing, don’t do business with them. Keep in mind that if you hire them, this individual will handle your sensitive personal information – information you need to keep safe from corrupt or fraudulent tax preparers.

If you think you’ve been the victim of ID theft or tax scams, you can report them to BBB’s Scam Tracker at bbb.org/scamtracker. For additional information, or to research trustworthy tax preparers, visit bbb.org. Visit irs.gov for deadlines and other important tax information.