The Pinehurst, Southern Pines, Aberdeen Area Convention and Visitors Bureau (CVB) voted to increase the nightly hotel occupancy tax from 3% to 6% at its June 24 meeting. A 6% tax rate over a 10-year period with 5% annual growth generates $30,791,015 for destination enhancement and $59,770,793 for marketing investment.

Moore County Commissioner Frank Quis said to present the request for the tax increase to the commissioners for the July meeting in a one-page letter with the concept.

“You’ll have to wait and see. I’ll be gone in November, and you’ll have to ask another gentleman,” Quis said about not having discussed this proposed tax increase with fellow commissioners.

Commissioners will discuss the tax increase before voting.

Chris Cavanaugh, a tourism consultant from Asheville, explained the hotel occupancy tax in his destination enhancement presentation. The discussion of increasing the tax began four years ago, with the pandemic, and builds on the success of the 2023 One-Time Project Fund.

The Moore County Tourism Development Authority (MCTDA) follows legislation already in place, manages risks, creates legal protections and establishes priorities with policies, and is accountable with documented processes.

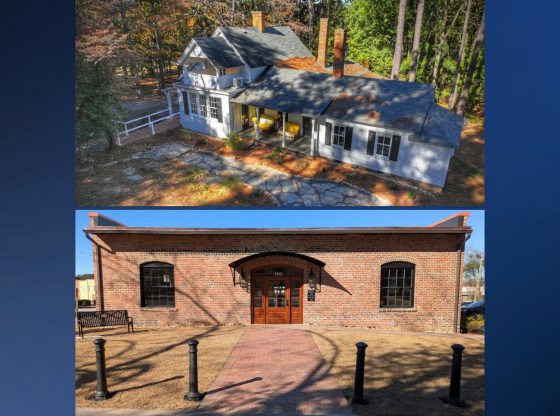

The MCTDA 2023 One-Time Project Fund awarded $821,000 to six projects, serving as an example of the benefits of increasing the hotel occupancy tax. The projects prove that MCTDA works seamlessly with officials in the reviewing process and is dedicated to serving communities by contributing tax dollars for capital projects with lasting effects.

MCTDA prefers shovel-ready projects with up to 50/50 fund matching for all applicants and must focus on enhancing the destination experience for both visitors and residents. Maintenance and studies will not be funded.

Examples of funded projects include arts and cultural amenities and venues, parks and greenways, sports complexes and ballparks, trail development, museum development and expansion, outdoor recreation assets, farmer’s markets, arena and auditorium renovations, and agritourism experiences.

Tourists pay the tax increase, not the county or residents.

The hotel occupancy tax rate includes all regulated overnight destinations, hotels, motels, bed-and-breakfasts, and Airbnbs.

Feature photo: Chris Cavanaugh presents the destination enhancement plan for increasing the hotel occupancy tax rate on June 24, 2024, at the CVB meeting.

~Article and photo by Sandhills Sentinel journalist Stephanie M. Sellers. Stephanie is also an English instructor at Central Carolina Community College. She is the author of young adult fiction, including When the Yellow Slugs Sing and Sky’s River Stone, and a suspense, GUTTERSNIPE: Shakespearean English Stage Play with Translation.